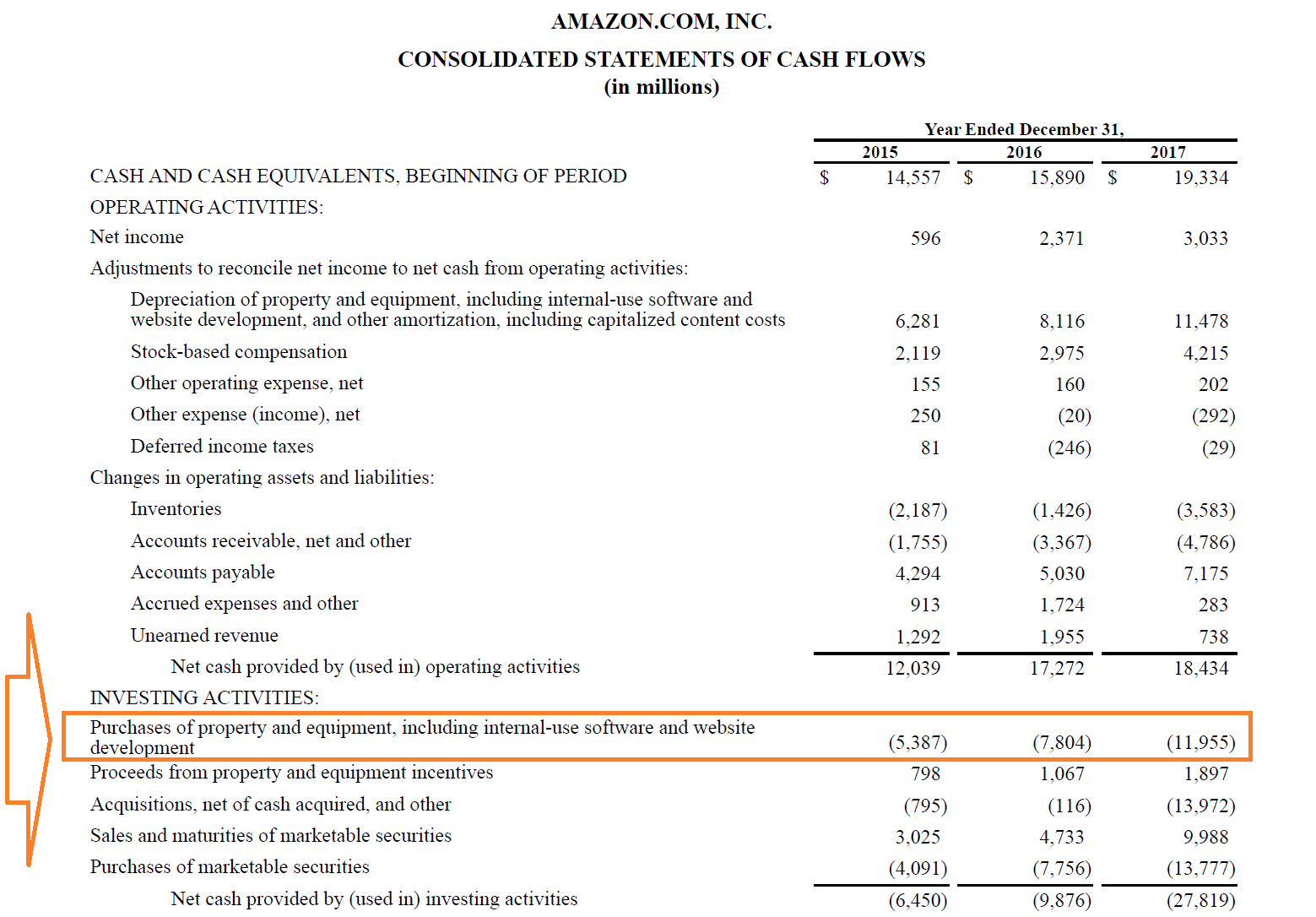

How To Record Capital Expenditure In Accounting . Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. These capital assets usually consist. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance.

from douglasbaseball.com

Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. These capital assets usually consist. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e).

Capital Expenditure Report Template

How To Record Capital Expenditure In Accounting Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. These capital assets usually consist. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance. Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable.

From studylib.net

Accounting for Capital Expenditure How To Record Capital Expenditure In Accounting Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. These capital assets usually consist.. How To Record Capital Expenditure In Accounting.

From tutorstips.com

What is Expenditure its types and examples Tutor's Tips How To Record Capital Expenditure In Accounting Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately. How To Record Capital Expenditure In Accounting.

From www.chegg.com

Solved QS 89 (Algo) Revenue and capital expenditures LO C3 How To Record Capital Expenditure In Accounting These capital assets usually consist. Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital. How To Record Capital Expenditure In Accounting.

From www.investopedia.com

How do capital and revenue expenditures differ? How To Record Capital Expenditure In Accounting Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). These capital assets usually consist. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Capital expenditures are payments that are made for goods or services that. How To Record Capital Expenditure In Accounting.

From www.exceltemple.com

Capital Expenditure Budget Template Excel ExcelTemple How To Record Capital Expenditure In Accounting Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately. How To Record Capital Expenditure In Accounting.

From courses.lumenlearning.com

Capitalization versus Expensing Financial Accounting How To Record Capital Expenditure In Accounting Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period.. How To Record Capital Expenditure In Accounting.

From www.vencru.com

Expense Report Templates Vencru How To Record Capital Expenditure In Accounting Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure is. How To Record Capital Expenditure In Accounting.

From www.erp-information.com

What is Capital Expenditure? (Types, Formula, and Challenges) How To Record Capital Expenditure In Accounting Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. These capital. How To Record Capital Expenditure In Accounting.

From www.youtube.com

Capital Expenditure, Accounting Lecture Sabaq.pk YouTube How To Record Capital Expenditure In Accounting Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Capital expenditures are payments that. How To Record Capital Expenditure In Accounting.

From www.pinterest.com

Sample Capital Expenditure Budget Capital expenditure, Budgeting How To Record Capital Expenditure In Accounting Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditures are payments that are made for goods or services that are recorded or capitalized on. How To Record Capital Expenditure In Accounting.

From www.pinterest.com

Capital Expenditure Budget in 2021 Capital expenditure, Budgeting How To Record Capital Expenditure In Accounting Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. These capital assets usually consist. Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant,. How To Record Capital Expenditure In Accounting.

From www.youtube.com

FA2 Lecture 1 Accounting Equation Capital Calculation Basic How To Record Capital Expenditure In Accounting Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment. How To Record Capital Expenditure In Accounting.

From data1.skinnyms.com

Capital Expenditure Excel Template How To Record Capital Expenditure In Accounting Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. These capital assets usually consist. Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's. How To Record Capital Expenditure In Accounting.

From www.accountingcapital.com

What is Revenue Expenditure? Accounting Capital How To Record Capital Expenditure In Accounting Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance. These capital assets usually consist. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it. How To Record Capital Expenditure In Accounting.

From www.eloquens.com

Capital Expenditure Forecast Excel Model Template Eloquens How To Record Capital Expenditure In Accounting Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. These capital. How To Record Capital Expenditure In Accounting.

From studylib.net

Capital Expenditure How To Record Capital Expenditure In Accounting Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's balance. Accounting for a capital expenditure a capital expenditure is recorded as an asset, rather than charging it immediately to expense. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Effective. How To Record Capital Expenditure In Accounting.

From accountingo.org

Capital and Revenue Expenditures A Beginners Guide How To Record Capital Expenditure In Accounting Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Capital expenditures are recorded on cash flow statements under investing activities and on the balance sheet, usually under property, plant, and equipment (pp&e). Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company's. How To Record Capital Expenditure In Accounting.

From tutorstips.com

What is and Expenditures Account format in Excel & PDF How To Record Capital Expenditure In Accounting Capital expenditure (capex) of a business is the total capital spent on buying, maintaining, and upgrading fixed assets. Effective management of both types of expenditures is essential for maintaining financial stability and achieving sustainable. Capital expenditure is expenditure that is expected to generate economic benefits for a company in more than one period. Capital expenditures are recorded on cash flow. How To Record Capital Expenditure In Accounting.